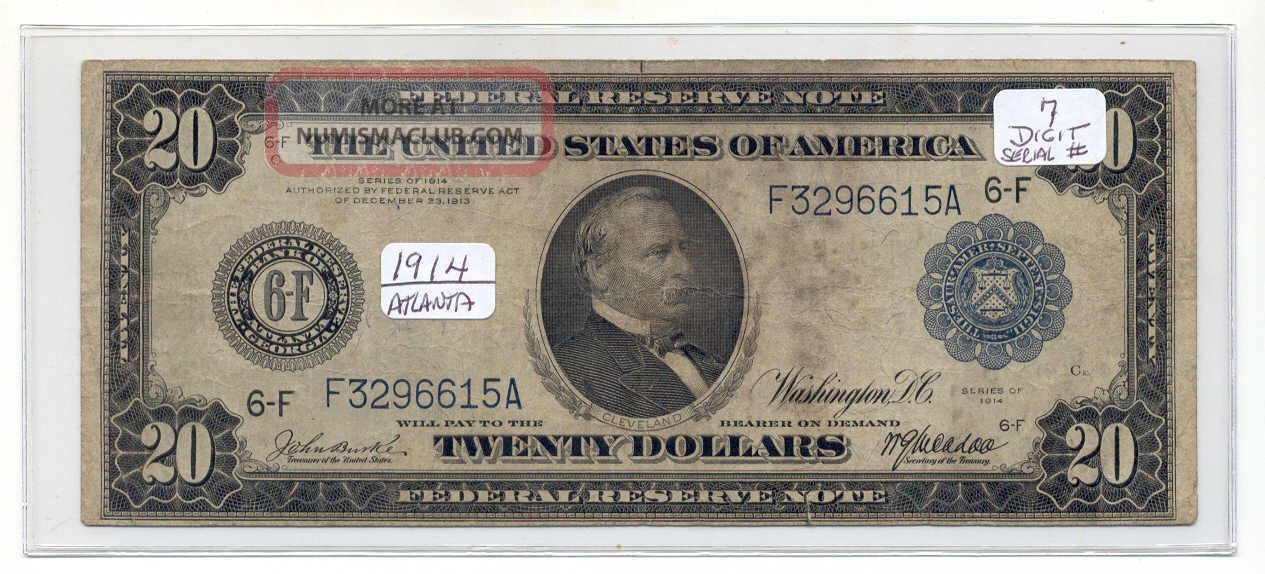

The supply of notes was largely unresponsive to changes in demand, especially when an unforeseen event or news caused bank customers to worry about the safety of their deposits and “run” to their banks to withdraw cash. The volume of notes that a national bank could issue was tied to the amount of U.S. The national banking acts of the 1860s created an environment in which most of the nation’s currency consisted of notes issued by national banks (commercial banks with charters issued by the federal government) comprised most of the nation’s currency. Such panics were widely blamed on the nation’s “inelastic currency.” Banking panics-events characterized by widespread bank runs and payments suspensions and, to a degree, outright bank failures-had occurred often throughout the 19 th century. Perhaps most important was to make the American banking system more stable. It also includes short biographies of Federal Reserve Board members and Reserve Bank presidents.įounded by an act of Congress in 1913, the Federal Reserve System was established with several goals in mind. The site is organized around eight time periods in the Fed’s history, with essays devoted to key events, policy actions, legislation, and the everyday work of Fed employees during each period. The purpose of this site is to help demystify the Fed and its role in the economy, and to explain how the Fed and its mission have evolved over its more than 100-year history. The Fed has a complex structure and mission. This website serves as a gateway to the history of the Federal Reserve for educators, students, and the general public.

The Federal Reserve System (“Fed”) is the central bank of the United States. The Great Financial Crisis, Recession, and Aftermath.

0 kommentar(er)

0 kommentar(er)